Αrt2788 Δευτερα 20 Φεβρουαρίου 2017

Oil prices push higher, lifted by decline in Saudi exports

By Barbara Kollmeyer and Jenny W. Hsu

Getty Images

Crude futures moved higher on Monday, lifted by fresh data showing a decline in Saudi Arabian oil exports, which helped soothe markets some after a U.S. rig-count spike last week.On the New York Mercantile Exchange, light, sweet crude futures for delivery in March CLJ7, +0.39% traded at $53.77 a barrel, up 37 cents, or 0.7%. April Brent crude LCOJ7, +0.56% on London’s ICE Futures exchange added 44 cents, or 0.8%, to $56.24 a barrel.

Supporting prices, data on Monday showed Saudi Arabia exported 8.01 million barrels of crude per day in December, 244,000 barrels per day less than in November, which was a record-high month, said analysts at Commerzbank in a note to clients. The data comes from the Joint Oil Data Initiative, the analysts said.

But the Commerzbank team said the data should be viewed against this backdrop: “Ahead of the agreed production cuts, Saudi Arabia had chosen not to reduce its output as it normally would have in the winter half year, so as to be able at a later date to make this appear part of the agreed reduction in production.”

While global cuts are supporting crude prices, the market keeps bumping up against signs of rising production in the U.S. Oil came under pressure over the weekend after data indicated the number of rigs drilling for oil in the U.S. rose by six. At 597, the count is the highest since October 2015.

Goldman Sachs said the current rig count implies that U.S. production will increase on average by 130,000 barrels a day, year-over-year, in 2017. The U.S. Department of Energy reported the U.S. produced 8.9 million barrels a day last year, and the tally is expected to rise to 9.0 million barrels a day this year.

Even though the current growth rate in U.S. production is not yet fast enough to derail the OPEC-led initiative, the worry is what will happen if the group does not renew its supply-cut agreement after June, said Vivek Dhar, commodities strategist at Commonwealth Bank of Australia.

“We are all watching if the rise in U.S. supply will push oil prices back to the high $40 and low $50s range in the second half of this year,” he said.

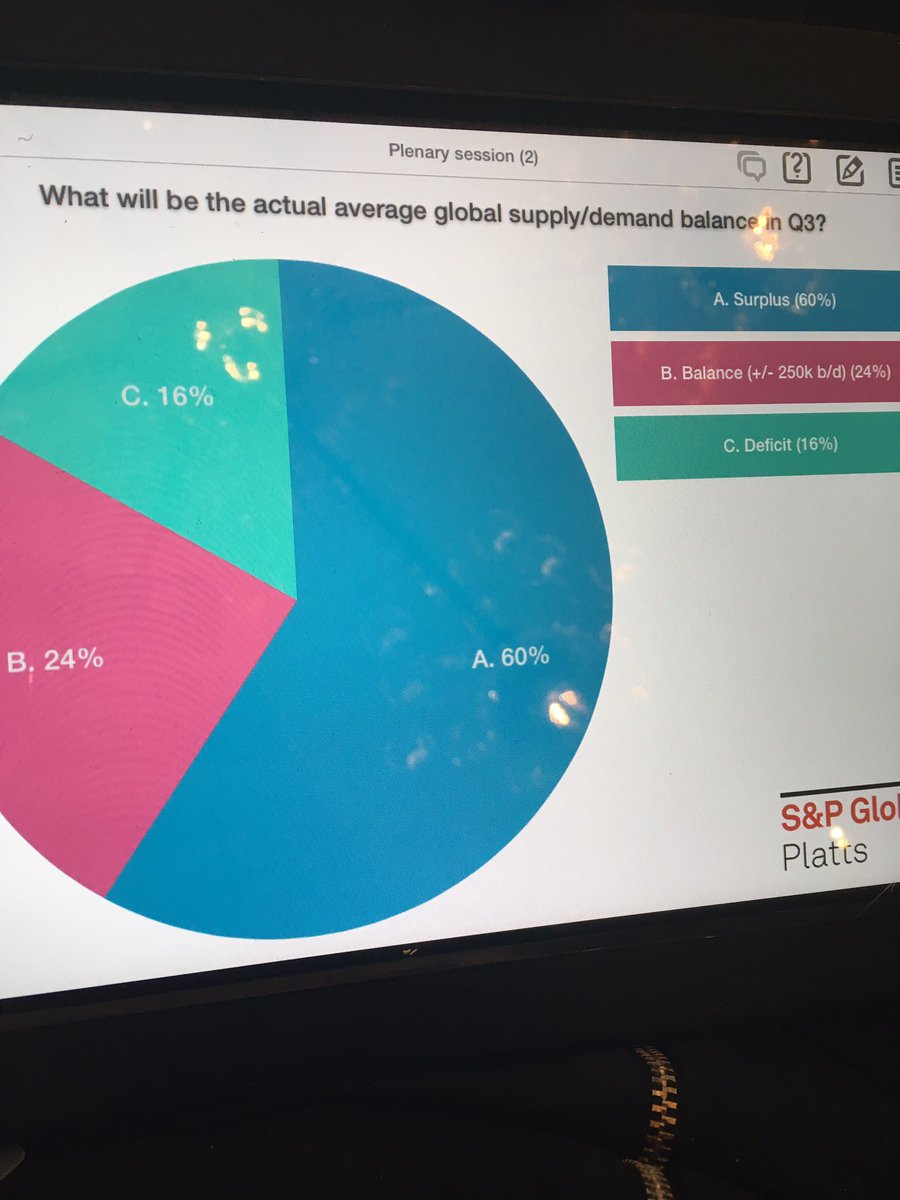

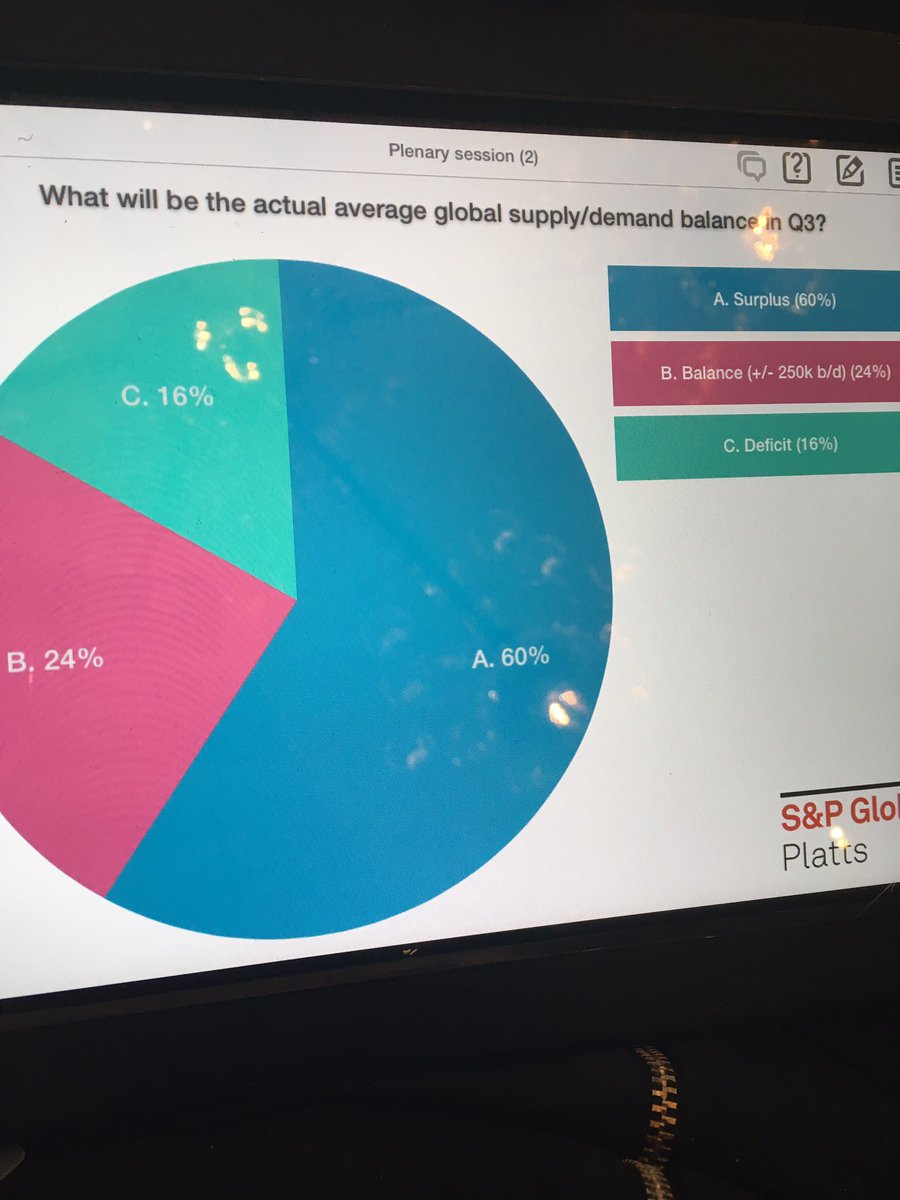

Delegates meeting at the Platts Oil Forum in London Monday said they expect Brent oil prices will trade in a range of $55-to-$65 a barrel in 12 months, but many believe oversupply will still be an issue later this year:

View image on Twitter

For this week, market watchers will be monitoring the weekly U.S. crude inventory and production data. The report is slated for release on Thursday, instead of the usual Wednesday, due to the public holiday on Monday.

China will also release its January final oil trade data on Thursday. It is expected to confirm preliminary data, which showed China’s crude imports rose 28% year-on-year to 8 million barrels a day.

Nymex reformulated gasoline blendstock for March RBH7, -0.21% — the benchmark gasoline contract — rose one penny, or 0.5%, to $1.5224 a gallon.

More from MarketWatch

www.fotavgeia.blogspot.com

Oil prices push higher, lifted by decline in Saudi exports

By Barbara Kollmeyer and Jenny W. Hsu

Getty Images

Crude futures moved higher on Monday, lifted by fresh data showing a decline in Saudi Arabian oil exports, which helped soothe markets some after a U.S. rig-count spike last week.On the New York Mercantile Exchange, light, sweet crude futures for delivery in March CLJ7, +0.39% traded at $53.77 a barrel, up 37 cents, or 0.7%. April Brent crude LCOJ7, +0.56% on London’s ICE Futures exchange added 44 cents, or 0.8%, to $56.24 a barrel.

Supporting prices, data on Monday showed Saudi Arabia exported 8.01 million barrels of crude per day in December, 244,000 barrels per day less than in November, which was a record-high month, said analysts at Commerzbank in a note to clients. The data comes from the Joint Oil Data Initiative, the analysts said.

But the Commerzbank team said the data should be viewed against this backdrop: “Ahead of the agreed production cuts, Saudi Arabia had chosen not to reduce its output as it normally would have in the winter half year, so as to be able at a later date to make this appear part of the agreed reduction in production.”

While global cuts are supporting crude prices, the market keeps bumping up against signs of rising production in the U.S. Oil came under pressure over the weekend after data indicated the number of rigs drilling for oil in the U.S. rose by six. At 597, the count is the highest since October 2015.

Goldman Sachs said the current rig count implies that U.S. production will increase on average by 130,000 barrels a day, year-over-year, in 2017. The U.S. Department of Energy reported the U.S. produced 8.9 million barrels a day last year, and the tally is expected to rise to 9.0 million barrels a day this year.

Even though the current growth rate in U.S. production is not yet fast enough to derail the OPEC-led initiative, the worry is what will happen if the group does not renew its supply-cut agreement after June, said Vivek Dhar, commodities strategist at Commonwealth Bank of Australia.

“We are all watching if the rise in U.S. supply will push oil prices back to the high $40 and low $50s range in the second half of this year,” he said.

Delegates meeting at the Platts Oil Forum in London Monday said they expect Brent oil prices will trade in a range of $55-to-$65 a barrel in 12 months, but many believe oversupply will still be an issue later this year:

View image on Twitter

For this week, market watchers will be monitoring the weekly U.S. crude inventory and production data. The report is slated for release on Thursday, instead of the usual Wednesday, due to the public holiday on Monday.

China will also release its January final oil trade data on Thursday. It is expected to confirm preliminary data, which showed China’s crude imports rose 28% year-on-year to 8 million barrels a day.

Nymex reformulated gasoline blendstock for March RBH7, -0.21% — the benchmark gasoline contract — rose one penny, or 0.5%, to $1.5224 a gallon.

More from MarketWatch

www.fotavgeia.blogspot.com

Δεν υπάρχουν σχόλια:

Δημοσίευση σχολίου