Hong Kong: The International Maritime Center

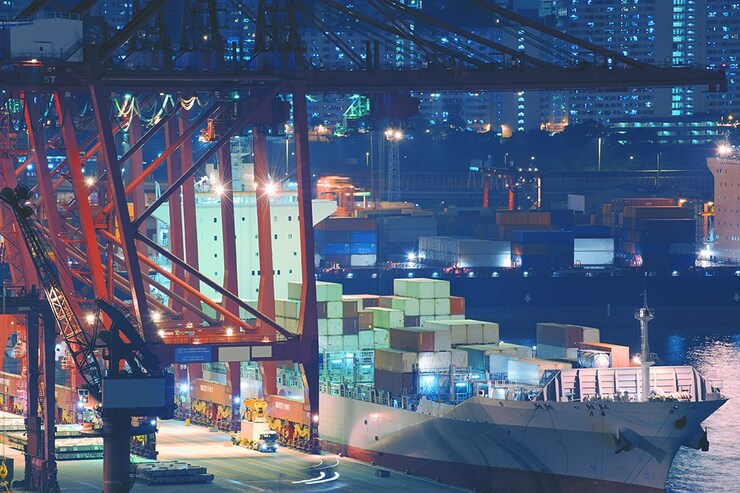

Hong Kong is one of the world’s most important maritime centers. Home to the fourth-largest ship register, with a total of about 120 million gross tonnes, and fifth-busiest container port, Hong Kong’s maritime industry has traditionally been one of the key pillars of its vibrant economy. The city’s liner services connect to 470 destinations a week, and sea-cargo operations serve 58 countries along the Belt and Road corridors.

Hong Kong is one of the world’s most important maritime centers. Home to the fourth-largest ship register, with a total of about 120 million gross tonnes, and fifth-busiest container port, Hong Kong’s maritime industry has traditionally been one of the key pillars of its vibrant economy. The city’s liner services connect to 470 destinations a week, and sea-cargo operations serve 58 countries along the Belt and Road corridors.

Leading shipowners, ship operators and tonnage providers have historically been drawn to Hong Kong as a base by a variety of factors: its international finance center, world-class port, established common-law system, proximity to Asia’s major markets, a stable and competitive tax regime, a dynamic workforce, and its continuing status as the world’s freest economy. This in turn has propagated a thriving ecosystem of maritime financiers, insurers, legal service providers, ship brokers and management companies.

In the last decade, however, Hong Kong’s drive to build an attractive base for the commercial principals of the industry has been challenged by strong competition from other major shipping centers. This is partly the result of a shift in the structure of Hong Kong’s economy away from manufacturing and toward finance and services. But with China’s Belt and Road and Greater Bay Area initiatives potentially triggering enormous growth in regional trade, Hong Kong’s maritime sector is assuming a renewed importance.

As Chief Executive of Hong Kong Carrie Lam noted in her speech to the Global Maritime Forum Summit in October 2018, “maintaining the competitiveness of our maritime sector remains a formidable challenge.”

Source: Lloyd's List

This year, the Financial Services Development Council (FSDC) published a research report highlighting the issues facing Hong Kong’s maritime cluster and the steps it needs to take to move back to the forefront of a global business that carries more than 80 percent of the world’s goods. These recommendations were consolidated in the Chief Executive’s 2018 policy address, released in October, which laid out the administration’s plans for the sector in the coming year.

Simplifying Tax

Luring more of shipping’s major commercial principals to Hong Kong is one of the key tasks ahead. Already, more than 800 companies are engaged in the international maritime business in Hong Kong, along with almost 90 authorized ship insurers.

Stability, certainty and predictability are key factors in choosing a base for a shipping business, so a transparent and consistent tax policy is crucial. For many years, the bedrock of Hong Kong’s maritime cluster has been Section 23B of the Inland Revenue Ordinance, under which Hong Kong-registered vessels engaged in international trade are exempt from profits tax on charter income.

Currently, Section 23B applies to the income of shipowners but doesn’t apply to businesses that serve and support vessels. In her policy address, the Chief Executive pledged to explore the feasibility of tax concessions as a means of attracting more maritime leasing companies to set up and expand in Hong Kong, responding positively to the FSDC’s proposal in May to introduce policies that provide more tax certainties and incentives for Hong Kong-based maritime businesses, such as a concessional tax rate on profit of 8.25 percent (versus the standard 16.5 percent) for ship-leasing and maritime-related support and management services.

The Chief Executive also recommended implementing tax-relief measures to promote the development of marine insurance and specialty risks, enabling Hong Kong to compete more effectively with maritime hubs like Singapore that currently offer a broad range of incentives.

Enhancing the Register

The Hong Kong Ship Register (HKSR) has been seen as the barometer of its maritime success, and the 2018 policy address announced measures to enhance the register’s services by “setting up regional desks in selected government’s overseas and mainland offices to provide support to shipowners and promote the HKSR.”

Globally, the shipping industry is undergoing a crucial phase of transition. Operating costs are rising; traditional sources of ship financing are shrinking; new rules on tax havens and profit-shifting are forcing operators to seek new bases; and the Belt and Road Initiative is beginning to redraw the map of global trade and develop new markets.

Each of these developments opens an opportunity for Hong Kong, and the administration’s planned package of measures is aimed at capitalizing on those opportunities.

In addition, the FSDC report recommended Hong Kong “put more effort into negotiating more double-taxation agreements (DTAs).” Currently Hong Kong has concluded double taxation relief arrangements covering shipping income with 47 tax administrations, and the FSDC report urged the administration to pursue new agreements with jurisdictions that are crucial to the maritime industry, such as Australia and Brazil.

The Next Generation

The future development of Hong Kong’s maritime cluster will depend to a significant degree on the availability of quality labor. In 2018-19, following the success of previous schemes, Hong Kong’s administration will inject $200 million into the Maritime and Aviation Training Fund to support the introduction of new schemes that will benefit more students and help existing industry employees improve their skills.

Upgrading for the Future

To maintain the competitiveness of Hong Kong Port, the government has planned a program of progressive enhancement, including the provision of additional terminal yard space and barge berths to increase the handling capacity of the Kwai Tsing Container Terminals and make better use of the terminals’ back-up land. Chief Executive Lam’s policy address also outlined plans to identify suitable sites for the development of modern logistics facilities for high value-added third-party services.

Connecting the Belt and Road

The Belt and Road Initiative represents possibly the largest marshalling of development capital in human history. Hong Kong’s geographic location and broad base of expertise position it as a key hub for both the Belt and Road and the Greater Bay Area alignment projects as trade booms along both maritime and overland corridors. Hong Kong has several important advantages:

High standard of corporate governance

Abundant talent pool

Track record of managing and operating mature projects

Large and diversified pool of investors

Comprehensive road and high-speed rail networks linking container terminals, airport and logistics nodes with mainland China and Macao

World’s largest pool of renminbi deposits at RMB595.1bn

Largest outstanding dim sum bond market at RMB256.8bn

Large daily clearing and settlement turnover at RMB871.5bn

Hong Kong is also well-prepared to play a vital role in overseas infrastructure investments through its Infrastructure Financing Facilitation Office, which has 77 major corporate members. That role was strengthened in 2017 when the Asia Infrastructure Investment Bank approved Hong Kong’s membership, highlighting the city’s importance to Belt and Road finance, including project loans, bond issuance, treasury management and private equity investments.

Hong Kong companies have established a strong footprint through the Belt and Road, from COSCO’s purchase of Greece’s Port of Piraeus, to CMPort’s investment in Djibouti, to MTR Corporation’s rail operations in mainland China.

“The Belt and Road Initiative and the Bay Area will create surging needs for legal and dispute-resolution expertise, as well as other professional services, including investment and risk assessment, research, financing, insurance and accounting,” Chief Executive Lam said. “We have all the professionals here in Hong Kong, working with clients from the mainland and from all over the world. They give Hong Kong our clear competitive edge, providing high value-added services for mainland companies looking to go out to the world and for a world of companies looking to the booming markets of the mainland and throughout Asia.”

“As an international maritime center and global trade and investment hub, Hong Kong has what it takes to be the business bridge between East and West,” Lam said.

www.fotavgeia.blogspot.com

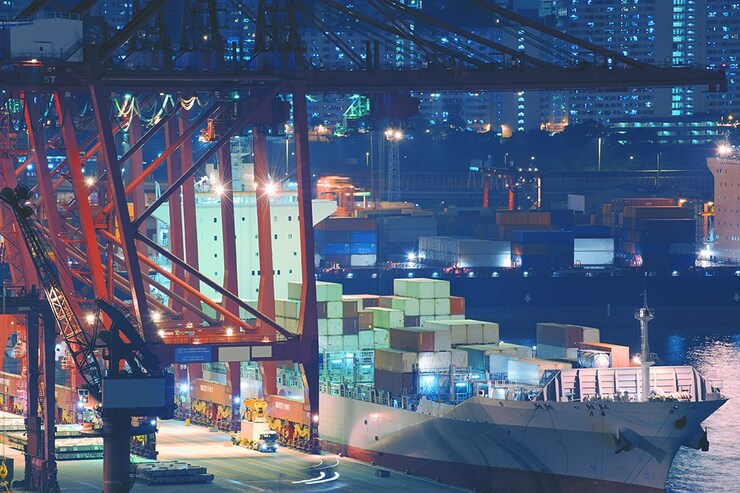

Hong Kong is one of the world’s most important maritime centers. Home to the fourth-largest ship register, with a total of about 120 million gross tonnes, and fifth-busiest container port, Hong Kong’s maritime industry has traditionally been one of the key pillars of its vibrant economy. The city’s liner services connect to 470 destinations a week, and sea-cargo operations serve 58 countries along the Belt and Road corridors.

Hong Kong is one of the world’s most important maritime centers. Home to the fourth-largest ship register, with a total of about 120 million gross tonnes, and fifth-busiest container port, Hong Kong’s maritime industry has traditionally been one of the key pillars of its vibrant economy. The city’s liner services connect to 470 destinations a week, and sea-cargo operations serve 58 countries along the Belt and Road corridors.Leading shipowners, ship operators and tonnage providers have historically been drawn to Hong Kong as a base by a variety of factors: its international finance center, world-class port, established common-law system, proximity to Asia’s major markets, a stable and competitive tax regime, a dynamic workforce, and its continuing status as the world’s freest economy. This in turn has propagated a thriving ecosystem of maritime financiers, insurers, legal service providers, ship brokers and management companies.

In the last decade, however, Hong Kong’s drive to build an attractive base for the commercial principals of the industry has been challenged by strong competition from other major shipping centers. This is partly the result of a shift in the structure of Hong Kong’s economy away from manufacturing and toward finance and services. But with China’s Belt and Road and Greater Bay Area initiatives potentially triggering enormous growth in regional trade, Hong Kong’s maritime sector is assuming a renewed importance.

As Chief Executive of Hong Kong Carrie Lam noted in her speech to the Global Maritime Forum Summit in October 2018, “maintaining the competitiveness of our maritime sector remains a formidable challenge.”

Source: Lloyd's List

This year, the Financial Services Development Council (FSDC) published a research report highlighting the issues facing Hong Kong’s maritime cluster and the steps it needs to take to move back to the forefront of a global business that carries more than 80 percent of the world’s goods. These recommendations were consolidated in the Chief Executive’s 2018 policy address, released in October, which laid out the administration’s plans for the sector in the coming year.

Simplifying Tax

Luring more of shipping’s major commercial principals to Hong Kong is one of the key tasks ahead. Already, more than 800 companies are engaged in the international maritime business in Hong Kong, along with almost 90 authorized ship insurers.

Stability, certainty and predictability are key factors in choosing a base for a shipping business, so a transparent and consistent tax policy is crucial. For many years, the bedrock of Hong Kong’s maritime cluster has been Section 23B of the Inland Revenue Ordinance, under which Hong Kong-registered vessels engaged in international trade are exempt from profits tax on charter income.

Currently, Section 23B applies to the income of shipowners but doesn’t apply to businesses that serve and support vessels. In her policy address, the Chief Executive pledged to explore the feasibility of tax concessions as a means of attracting more maritime leasing companies to set up and expand in Hong Kong, responding positively to the FSDC’s proposal in May to introduce policies that provide more tax certainties and incentives for Hong Kong-based maritime businesses, such as a concessional tax rate on profit of 8.25 percent (versus the standard 16.5 percent) for ship-leasing and maritime-related support and management services.

The Chief Executive also recommended implementing tax-relief measures to promote the development of marine insurance and specialty risks, enabling Hong Kong to compete more effectively with maritime hubs like Singapore that currently offer a broad range of incentives.

Enhancing the Register

The Hong Kong Ship Register (HKSR) has been seen as the barometer of its maritime success, and the 2018 policy address announced measures to enhance the register’s services by “setting up regional desks in selected government’s overseas and mainland offices to provide support to shipowners and promote the HKSR.”

Globally, the shipping industry is undergoing a crucial phase of transition. Operating costs are rising; traditional sources of ship financing are shrinking; new rules on tax havens and profit-shifting are forcing operators to seek new bases; and the Belt and Road Initiative is beginning to redraw the map of global trade and develop new markets.

Each of these developments opens an opportunity for Hong Kong, and the administration’s planned package of measures is aimed at capitalizing on those opportunities.

In addition, the FSDC report recommended Hong Kong “put more effort into negotiating more double-taxation agreements (DTAs).” Currently Hong Kong has concluded double taxation relief arrangements covering shipping income with 47 tax administrations, and the FSDC report urged the administration to pursue new agreements with jurisdictions that are crucial to the maritime industry, such as Australia and Brazil.

The Next Generation

The future development of Hong Kong’s maritime cluster will depend to a significant degree on the availability of quality labor. In 2018-19, following the success of previous schemes, Hong Kong’s administration will inject $200 million into the Maritime and Aviation Training Fund to support the introduction of new schemes that will benefit more students and help existing industry employees improve their skills.

Upgrading for the Future

To maintain the competitiveness of Hong Kong Port, the government has planned a program of progressive enhancement, including the provision of additional terminal yard space and barge berths to increase the handling capacity of the Kwai Tsing Container Terminals and make better use of the terminals’ back-up land. Chief Executive Lam’s policy address also outlined plans to identify suitable sites for the development of modern logistics facilities for high value-added third-party services.

Connecting the Belt and Road

The Belt and Road Initiative represents possibly the largest marshalling of development capital in human history. Hong Kong’s geographic location and broad base of expertise position it as a key hub for both the Belt and Road and the Greater Bay Area alignment projects as trade booms along both maritime and overland corridors. Hong Kong has several important advantages:

High standard of corporate governance

Abundant talent pool

Track record of managing and operating mature projects

Large and diversified pool of investors

Comprehensive road and high-speed rail networks linking container terminals, airport and logistics nodes with mainland China and Macao

World’s largest pool of renminbi deposits at RMB595.1bn

Largest outstanding dim sum bond market at RMB256.8bn

Large daily clearing and settlement turnover at RMB871.5bn

Hong Kong is also well-prepared to play a vital role in overseas infrastructure investments through its Infrastructure Financing Facilitation Office, which has 77 major corporate members. That role was strengthened in 2017 when the Asia Infrastructure Investment Bank approved Hong Kong’s membership, highlighting the city’s importance to Belt and Road finance, including project loans, bond issuance, treasury management and private equity investments.

Hong Kong companies have established a strong footprint through the Belt and Road, from COSCO’s purchase of Greece’s Port of Piraeus, to CMPort’s investment in Djibouti, to MTR Corporation’s rail operations in mainland China.

“The Belt and Road Initiative and the Bay Area will create surging needs for legal and dispute-resolution expertise, as well as other professional services, including investment and risk assessment, research, financing, insurance and accounting,” Chief Executive Lam said. “We have all the professionals here in Hong Kong, working with clients from the mainland and from all over the world. They give Hong Kong our clear competitive edge, providing high value-added services for mainland companies looking to go out to the world and for a world of companies looking to the booming markets of the mainland and throughout Asia.”

“As an international maritime center and global trade and investment hub, Hong Kong has what it takes to be the business bridge between East and West,” Lam said.

www.fotavgeia.blogspot.com

Δεν υπάρχουν σχόλια:

Δημοσίευση σχολίου