China can ‘win big battles’, economic team says as trade row with United States heats up

Statement released after Vice-Premier Liu He hosts first meeting of new-look Financial Stability and Development Committee

Zhou Xin

US-China trade warUS-China trade war: All storiesChina economy

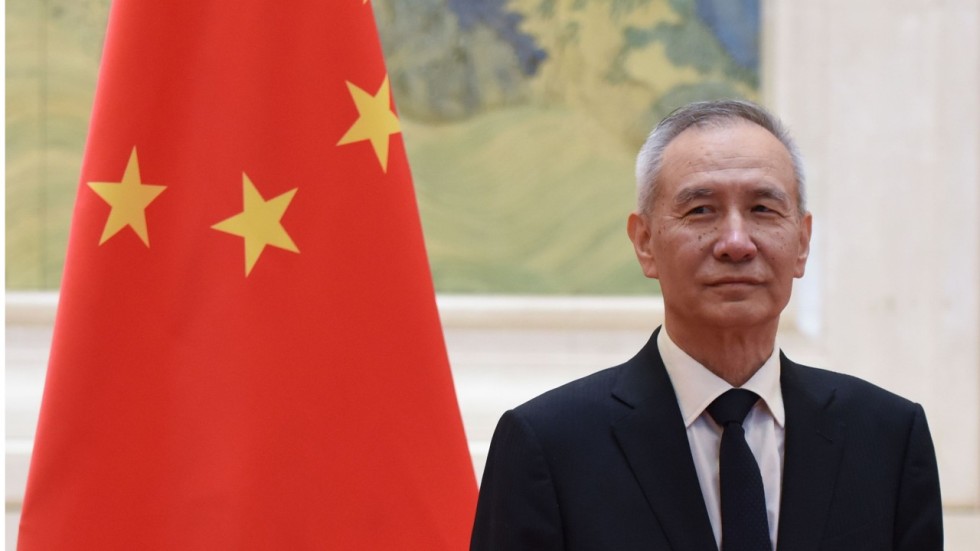

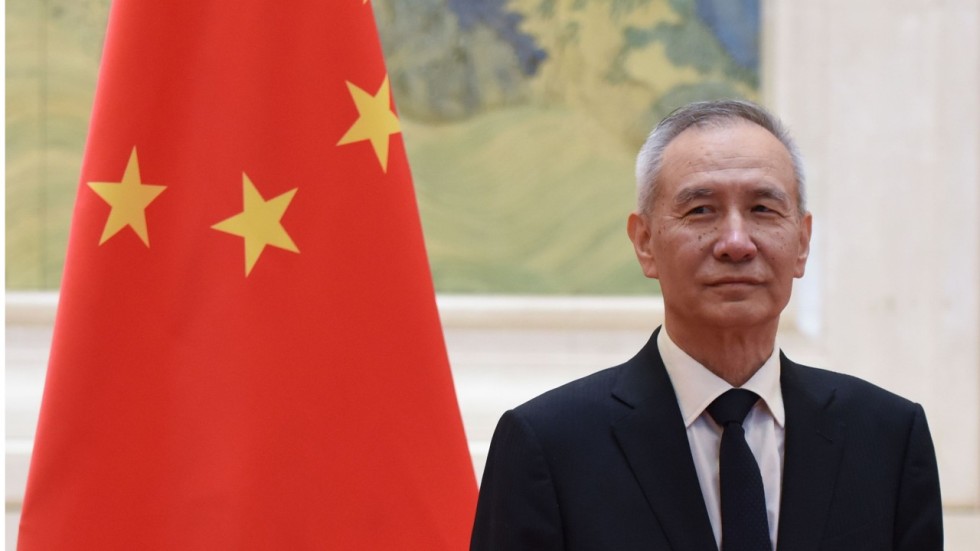

Chinese Vice-Premier Liu He on Monday chaired a meeting of the country’s top team responsible for managing and containing financial and economic risk, the government announced, just days before the US is set to impose new tariffs on goods imported from China.

The Financial Stability and Development Committee, which comprises some of President Xi Jinping’s must trusted officials, convened to discuss economic threats and “external risks”, according to a statement published late on Tuesday on the government’s website.

While it did not directly mention China’s long-running trade dispute with the US, it appeared to reference it by saying the country has “favourable conditions to win big risk control battles and cope with external risks”.

Are these Chinese export numbers an olive branch in the countdown to a trade war with the US?

The statement said also that Liu, who has spearheaded Beijing’s trade talks with Washington, listened to a report by People’s Bank of China governor Yi Gang on the government’s plans for handling financial risk through 2020.

Yi is also a vice-chairman of the committee and head of its office at the central bank.

It seems likely the committee was behind the announcement made on Tuesday by the central bank that it would support the yuan.

China’s currency and stock market have been under considerable pressure in recent days, but after the announcement, made during the lunchtime trading break, both rallied. On the mainland, the Shanghai Composite Index reversed losses in the final hour of the day to close up 0.4 per cent, while in Hong Kong the Hang Seng Index recovered from a nine-month low. The value of the yuan against the US dollar also rose in afternoon trade.

Yuan bounces back to end longest losing streak, after PBOC says it will support currency

In an unprecedented move, the government statement also identified the other seven members of the committee. They are: Ding Xuedong, a deputy secretary general of the State Council and the group’s second deputy chairman; Guo Shuqing, chairman of the China Banking and Insurance Regulatory Commission; Liu Shiyu, chairman of the China Securities Regulatory Commission; Pan Gongsheng, head of the State Administration of Foreign Exchange; Han Wenxiu, a deputy director at the Office for the Financial and Economic Affairs Commission; Lian Weiliang, a deputy director of the National Development and Reform Commission; and Liu Wei, a vice-minister of finance.

As well as the regular members, Monday’s meeting was attended by the deputy heads not only of the Communist Party’s discipline committee, personnel department and propaganda unit, but also the country’s cyberspace administration, public security and justice ministries, and the supreme court.

China fails to attract foreign investors as US trade dispute continues to hit stocks, yuan

The website statement said that after its meeting, the committee concluded that China had achieved an initial victory in bringing financial risks under control and curbed the “barbarian expansion activities of a few institutions”, which it did not name.

It might have been referring to the government’s seizure of Anbang Insurance Group, the pending trial of Tomorrow Group boss Xiao Jianhua, or the controls imposed on powerful conglomerates like Dalian Wanda Group and HNA Group.

The committee also agreed that “China’s huge domestic market size offers great leeway” for Beijing to cope with external shocks, and that monetary authorities will go ahead with a “prudent and neutral” policy stance, according to the statement.

Beijing softens tone on debt crackdown as trade tensions threaten growth

Liao Qun, chief economist at China Citic Bank International, said the committee’s first meeting sent the message that China “has some room to move on policy to cushion the possible impact of the upcoming trade war”.

The US is expected to impose 25 per cent tariffs on US$34 billion worth of Chinese products on Friday and Beijing has pledged to retaliate. Trump, in turn, threatened to target a further US$200 billion of Chinese imports if Beijing hit back.

Additional reporting by Sidney Leng

www.fotavgeia.blogspot.com

Statement released after Vice-Premier Liu He hosts first meeting of new-look Financial Stability and Development Committee

Zhou Xin

US-China trade warUS-China trade war: All storiesChina economy

Chinese Vice-Premier Liu He on Monday chaired a meeting of the country’s top team responsible for managing and containing financial and economic risk, the government announced, just days before the US is set to impose new tariffs on goods imported from China.

The Financial Stability and Development Committee, which comprises some of President Xi Jinping’s must trusted officials, convened to discuss economic threats and “external risks”, according to a statement published late on Tuesday on the government’s website.

While it did not directly mention China’s long-running trade dispute with the US, it appeared to reference it by saying the country has “favourable conditions to win big risk control battles and cope with external risks”.

Are these Chinese export numbers an olive branch in the countdown to a trade war with the US?

The statement said also that Liu, who has spearheaded Beijing’s trade talks with Washington, listened to a report by People’s Bank of China governor Yi Gang on the government’s plans for handling financial risk through 2020.

Yi is also a vice-chairman of the committee and head of its office at the central bank.

It seems likely the committee was behind the announcement made on Tuesday by the central bank that it would support the yuan.

China’s currency and stock market have been under considerable pressure in recent days, but after the announcement, made during the lunchtime trading break, both rallied. On the mainland, the Shanghai Composite Index reversed losses in the final hour of the day to close up 0.4 per cent, while in Hong Kong the Hang Seng Index recovered from a nine-month low. The value of the yuan against the US dollar also rose in afternoon trade.

Yuan bounces back to end longest losing streak, after PBOC says it will support currency

In an unprecedented move, the government statement also identified the other seven members of the committee. They are: Ding Xuedong, a deputy secretary general of the State Council and the group’s second deputy chairman; Guo Shuqing, chairman of the China Banking and Insurance Regulatory Commission; Liu Shiyu, chairman of the China Securities Regulatory Commission; Pan Gongsheng, head of the State Administration of Foreign Exchange; Han Wenxiu, a deputy director at the Office for the Financial and Economic Affairs Commission; Lian Weiliang, a deputy director of the National Development and Reform Commission; and Liu Wei, a vice-minister of finance.

As well as the regular members, Monday’s meeting was attended by the deputy heads not only of the Communist Party’s discipline committee, personnel department and propaganda unit, but also the country’s cyberspace administration, public security and justice ministries, and the supreme court.

China fails to attract foreign investors as US trade dispute continues to hit stocks, yuan

The website statement said that after its meeting, the committee concluded that China had achieved an initial victory in bringing financial risks under control and curbed the “barbarian expansion activities of a few institutions”, which it did not name.

It might have been referring to the government’s seizure of Anbang Insurance Group, the pending trial of Tomorrow Group boss Xiao Jianhua, or the controls imposed on powerful conglomerates like Dalian Wanda Group and HNA Group.

The committee also agreed that “China’s huge domestic market size offers great leeway” for Beijing to cope with external shocks, and that monetary authorities will go ahead with a “prudent and neutral” policy stance, according to the statement.

Beijing softens tone on debt crackdown as trade tensions threaten growth

Liao Qun, chief economist at China Citic Bank International, said the committee’s first meeting sent the message that China “has some room to move on policy to cushion the possible impact of the upcoming trade war”.

The US is expected to impose 25 per cent tariffs on US$34 billion worth of Chinese products on Friday and Beijing has pledged to retaliate. Trump, in turn, threatened to target a further US$200 billion of Chinese imports if Beijing hit back.

Additional reporting by Sidney Leng

www.fotavgeia.blogspot.com

Δεν υπάρχουν σχόλια:

Δημοσίευση σχολίου